Get the free printable living trust forms pdf

Show details

Create Your Living Trust This product does not constitute the rendering of legal advice or services. This product is intended for informational use only and is not a substitute for legal advice. State

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign living trust forms

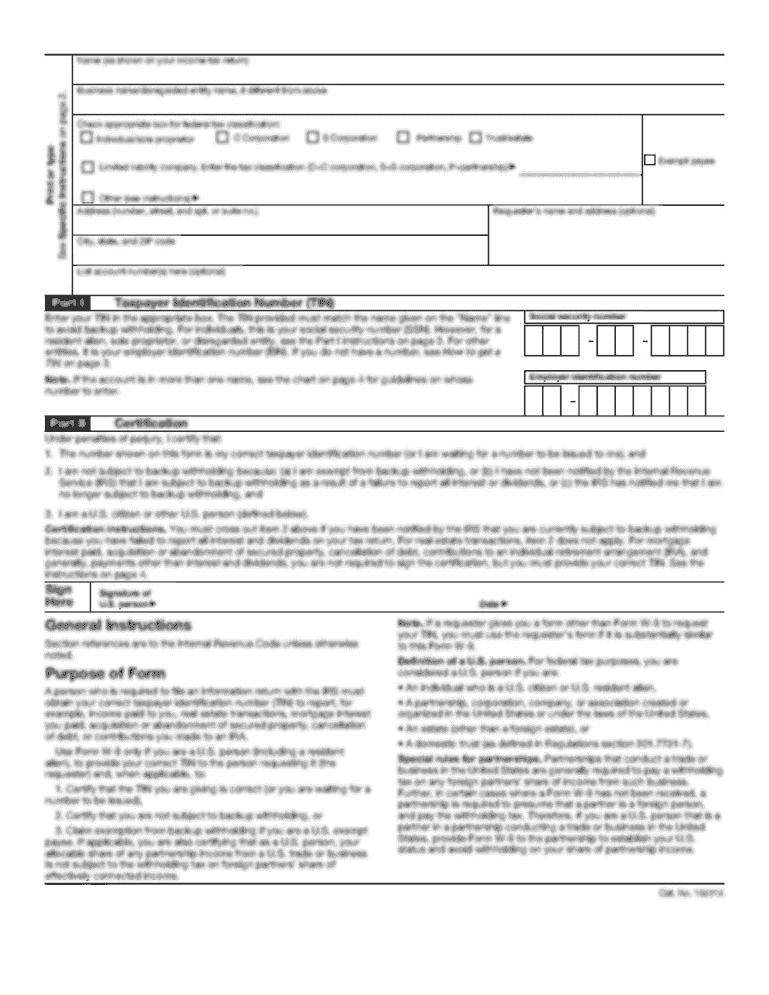

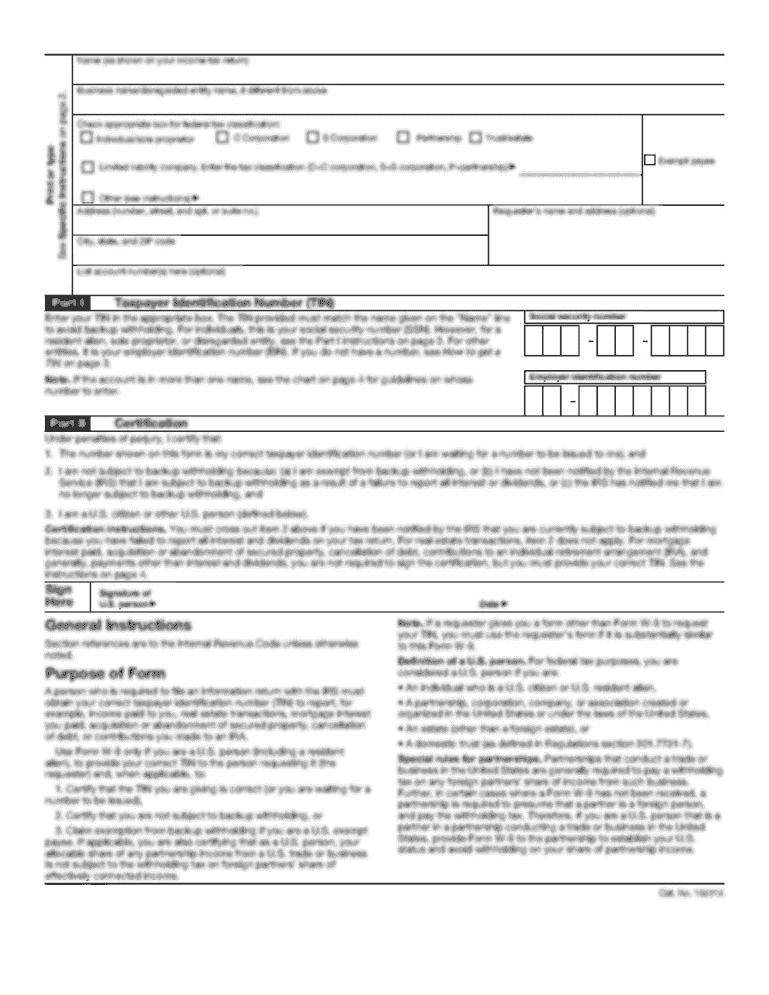

Edit your trust form pdf download form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your what is a printable living with state specific legal requirements form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit printable living trust forms online

Follow the steps below to take advantage of the professional PDF editor:

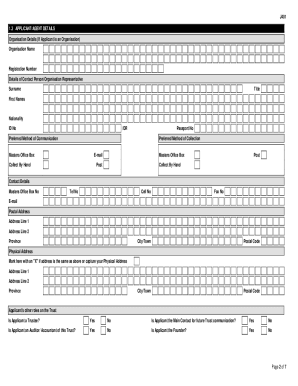

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit california living trust form pdf. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out living trust forms online

How to fill out printable living trust forms:

01

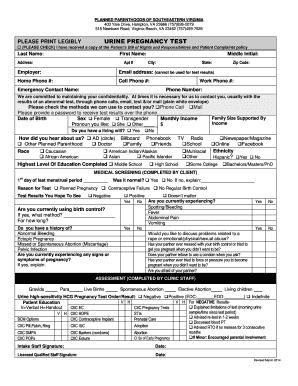

Begin by gathering all necessary information, such as your personal details, assets, and beneficiaries.

02

Carefully read through the instructions provided with the printable living trust forms to understand the specific requirements.

03

Start by filling out the personal information section, including your full name, address, and contact details.

04

Follow the prompts to identify and list your assets, including bank accounts, real estate, investments, and personal property.

05

Specify how you want your assets to be distributed among your chosen beneficiaries.

06

Determine who will serve as the trustee, the person responsible for managing and distributing the trust assets according to your wishes.

07

Sign and date the completed document in the presence of a notary public or witnesses, as required by law.

08

Make copies of the filled-out living trust forms for your records and distribute copies to relevant parties, such as your trustee, executor, and beneficiaries.

Who needs printable living trust forms:

01

Individuals who want to ensure that their assets are distributed according to their wishes after their death.

02

Those who wish to avoid the probate process, saving time and money for their beneficiaries.

03

People who have complex estate planning needs or specific instructions for asset distribution.

Fill

living trust forms pdf

: Try Risk Free

People Also Ask about living trust template

What documents do I need for living trust in California?

You will need all of the titles and deeds of property, stock certificates, and bank account statements in order to “fund the trust,” that is, to transfer the property into the trust, discussed more fully below. Gather them now and have them ready so the process can go more smoothly and quickly.

Do you need an attorney for a trust in California?

If you are trying to decide how to provide for the distribution of your assets or care of your children after you die and you need legal assistance, you should hire your own lawyer.

Can the IRS attach a living trust?

Irrevocable Trust If you don't pay next year's tax bill, the IRS can't usually go after the assets in your trust unless it proves you're pulling some sort of tax scam. If your trust earns any income, it has to pay income taxes. If it doesn't pay, the IRS might be able to lien the trust assets.

What are the disadvantages of a living trust?

Most people think the benefits outweigh the drawbacks, but before you make a living trust, you should be aware of them. Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

How do I set up a living trust in New Jersey?

To create a living trust in New Jersey, the trust document is signed by the trust-maker in front of a notary public, and then ownership of assets must be transferred into the name of the trust to make it effective. A living trust provides confidence that your assets will be managed and distributed exactly as you wish.

What are the disadvantages of a trust in California?

One of the primary disadvantages to using a trust is the cost necessary to establish it. It's generally more expensive to prepare a living trust than a will. You must create new deeds and other documents to transfer ownership of your assets into the trust after you form it.

How much is a living trust cost in California?

Generally, a Living Trust, produced by an attorney, ranges in price from $2,000 to $4,000. The Trust includes all documents required to establish the Trust, powers of attorney, both financial and healthcare-related. In California, a Will typically ranges from $400 to $700.

What assets should not be in a trust?

What assets cannot be placed in a trust? Retirement assets. While you can transfer ownership of your retirement accounts into your trust, estate planning experts usually don't recommend it. Health savings accounts (HSAs) Assets held in other countries. Vehicles. Cash.

Can I make my own living trust in California?

To make your trust valid in California, you simply need to sign the trust document — that's it! You don't need to have your document witnessed or notarized to make it valid. However, many people choose to sign their document in the presence of a notary public to help authenticate the document.

How long does it take to do a living trust in California?

It typically takes at least 8 months but can take up to several years. These delays have only gotten more severe in correlation with IRS slowdowns and COVID-related court closures.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find pdffiller?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific online trust forms and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

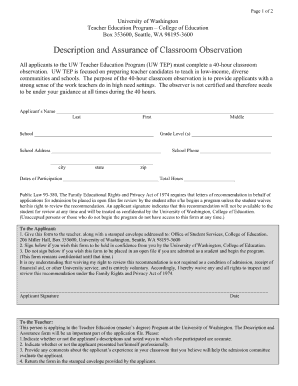

Can I sign the california living trust form electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How can I fill out revocable living trust form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your living trust forms california. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

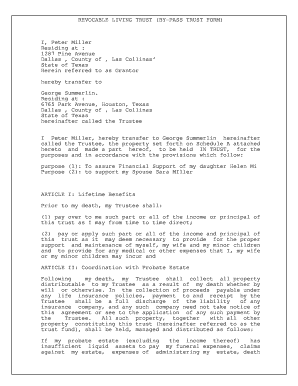

What is printable living trust forms?

Printable living trust forms are legal documents that allow individuals to create a living trust, which is a way to manage and distribute their assets during their lifetime and after death.

Who is required to file printable living trust forms?

Individuals who wish to establish a living trust to manage their assets and make distribution decisions after their death are required to fill out printable living trust forms.

How to fill out printable living trust forms?

To fill out printable living trust forms, individuals should gather personal information, details about their assets, beneficiaries, and any specific instructions for managing and distributing the trust assets, then complete the forms accurately.

What is the purpose of printable living trust forms?

The purpose of printable living trust forms is to create a legally binding document that outlines how an individual's assets will be managed during their lifetime and distributed after their death, avoiding probate.

What information must be reported on printable living trust forms?

Information that must be reported on printable living trust forms includes the trustor's personal details, a list of assets being placed in the trust, the names of beneficiaries, and any specific instructions regarding the distribution of assets.

Fill out your printable living trust forms online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Living Trust California Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to living trust forms california download

Related to online living trust forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.